PROPERTY MANAGEMENT

From leasing operation to property management

About the services after the purchase

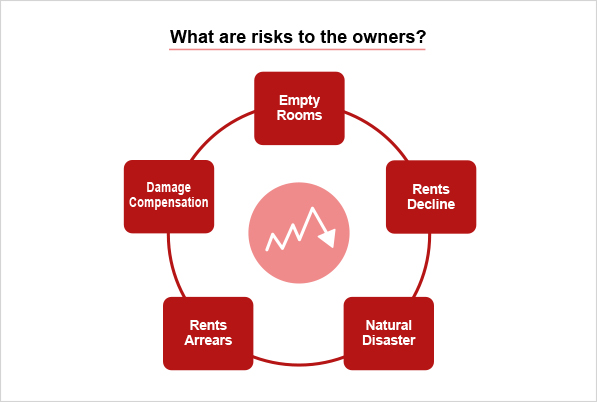

We'll offer you with the management service for your property, by which you can protect your property from the risks as mentioned below.

We'll offer you with the management service for your property, by which you can protect your property from the risks as mentioned below.

Operation and Flow of Property Management

Firstly, we`ll do the property management contract with you, an owner.

※The service fee of our property management for you is 5.4% of a monthly rent.

Main Property Management Operation

Collecting a rent

As it is very difficult for non-residents in Japan to open a bank account in Japan, we collect monthly rent on behalf of you. And if there is any arrears, we urge the tenant to pay the not-paid rents.

Customer service to tenants

If there is any complaints from the tenant or any troubles related with your property, we will be a one stop contact to address and solve them.

Rent statement

The rents collected will be accounted to your virtual account in our company and will be reported to you by a rent statement on a monthly basis.

Repair process

If there is any problems/troubles at the equipments/facilities of your property, we'll take a first step to get it checked by our staffs and if necessary, we use a repair agency to fix the problems/troubles.

Restoration/Renovation process

We conduct the process of restoration/renovation including cleaning the property and renovation when your property gets evacuated after the leasing contract termination.

Searching for new tenants

In order to have the minimization of your loss by the non-tenanted property, as soon as confirming the date of the tenant's evacuation, we take a process of advertisement to get a new tenant for your property.

Tax management

As an administrator of the tax management for your properties, we offer you a tax management service. The main process we take for the service is as below.

- Payment of Property acquisition tax for your purchased property

- Tax declaration & Income Tax Return process in March every year

- Payment of Fixed Asset/City Planning Taxes in June every year

The process above will be followed tax advices by our Certified Tax Account.